04

Our stellar track record

We develop and invest in complex digital-backed infrastructure investments boasting high profile tenants. Premium student accommodation and world-class health-tech opportunities.

We co-invest alongside our investors.

Our Projects >>

Student Accommodation

Digital Backed Infrastructure

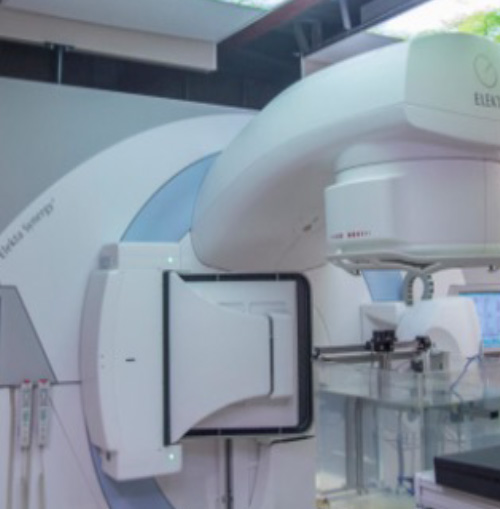

Namib Cancer Institute

Student Accommodation

Loverswalk

Investment Summary

A 466-bed commercial residential development to address a pressing need for student housing to cater for the University of Cape Town (UCT) and other educational institutions in the area. All our developments are analyzed on a case-by-case basis to ensure capital invested does not exceed the future fundamental value of the property. The scarcity of land and value of property in Rondebosch and surrounds strongly supports this simple principle.

This greenfield investment provided the opportunity to understand every facet of the property industry from the ground up. Funding was sourced from High-Net-Worth individuals and third-party debt from Investec Bank.

Construction commenced in May 2021. Practical completion is expected in September 2022.

Market value on completion is R400m.

Property market value: R387m.

Investment Highlights

Location

500m walk to UCT campus. Proximity to campus remains our key differentiator for current and any future projects. This is arguably the last developable piece of land of this size in Rondebosch. The last transfer was done in 1821.

Execution

The professional team have a track record and all lessons learnt from designing and constructing 1,500 student apartments in Stellenbosch.

Commercial Fundamentals

The University of Cape Town and other higher learning institutions in the area have a bed deficit in excess of 5000.

The Vet

Investment Summary

An 88-bed commercial residential development to address a pressing need for student housing to cater for the University of Cape Town (UCT) and other educational institutions in the area. All our developments are analyzed on a case-by-case basis to ensure capital invested does not exceed the future fundamental value of the property. The scarcity of land and value of property in Rondebosch and surrounds strongly supports this simple principle.

Construction will commence in February 2022. Practical completion is expected in November 2022.

Market value on completion is R80m.

Investment Highlights

Location

1km walk to UCT campus. Proximity to campus remains our key differentiator for current and any future projects.

Execution

The professional team have a track record and all lessons learnt from designing and constructing 1,500 student apartments in Stellenbosch.

Commercial Fundamentals

The University of Cape Town and other higher learning institutions in the area have a bed deficit in excess of 5000.

Digital Backed Infrastructure

Investment Summary

A Cape Town based commercial property developed in 2017. The Property tenanted by a Global Multinational.

The structural design of the building allows for redesign into residential accommodation. The property is located in the wider District Six precinct which is undergoing extensive urban renewal.

Property Market value R400m.

Investment Highlights

Location

Cape Town, Roeland Street, an upcoming and sort after neighborhood in Cape Town with easy access to the city and the Southern Suburbs. Proximity to the highway reduces travel time by 30 minutes.

Commercial Fundamentals

Tenanted by a Global multinational

Digital Backed Health Tech

Investment Summary

Addressing the Gap in the Availability of Oncology Treatment and Care in Africa.

Access to cancer care in peri-urban areas remains a challenge in most African countries.

The offering is a world-class oncology treatment with proximity to where patients live.

Investment value is R320m.

Investment Highlights

Location

South Africa and Namibia.

Execution

Relationship with the radiation oncologist who pioneered the idea. Partnership with a Global Owner Manufacturer with a track record.

Commercial Fundamentals

Investment case premised on insurance funded patients.

World class technology will allow brachytherapy treatment previously administered over six weeks to now being administered over two weeks. This reduces operating costs and further allows us to offer reduced rates to public patients.